|

Banks are a natural source for small business insurance, and small business customers need insurance.

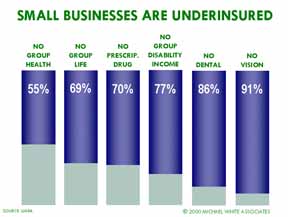

On average, a small business pays $6,300 in insurance premiums each year, but many remain underinsured, even uninsured.

(Click on the graph to enlarge.)

Banks can offer their small business customers group health insurance, group life and disability income protection, split dollar programs, key person insurance, funding for buy-sell agreements, retirement plans, and nonqualified deferred compensation plans. In doing so, banks not only enhance their core banking business, but they also increase their top-line revenue and bottom-line profits.

|

|

BankInsurance.comô, Michael White Associates, MWA and all associated text, logos and images are protected by trademark and copyright.

© Michael White Associates, LLC 1997-. All rights reserved.

|